Professional Reference: Business Frameworks

This document collates and synthesises key concepts, methodologies, and frameworks across business strategy, project management, leadership, and engineering disciplines. It aims to serve as a comprehensive reference for professional application and continuous learning.

📘 Professional Reference Compendium: Business and Technical Frameworks

This document collates and synthesizes key concepts, methodologies, and frameworks across business strategy, project management, leadership, and engineering disciplines. It aims to serve as a comprehensive reference for professional application and continuous learning.

Part 1: Business & Strategic Frameworks 🧠

Section 1: Strategic Planning & Business Model Formulation

This section delves into the foundational elements of creating and guiding a business. It starts with the overarching strategic planning process, then moves into the specifics of defining a business model, understanding different types of models, and formulating strategies at both corporate and business unit levels. It also covers how to achieve market leadership, leverage core strengths, foster innovation, and navigate the competitive legal landscape.

1.1 The Strategic Planning Process 🗺️

Strategic planning is a fundamental organizational activity that lays the groundwork for successful project implementation and defines the overall direction of an enterprise. It establishes the essential premises, managerial policies, and general criteria that orient future actions, providing a robust foundation upon which more detailed project and operational plans are constructed. The process is not merely about creating a static document ; rather, it is about engaging in a continuous cycle of assessment, goal setting, and strategy formulation to navigate a dynamic environment.

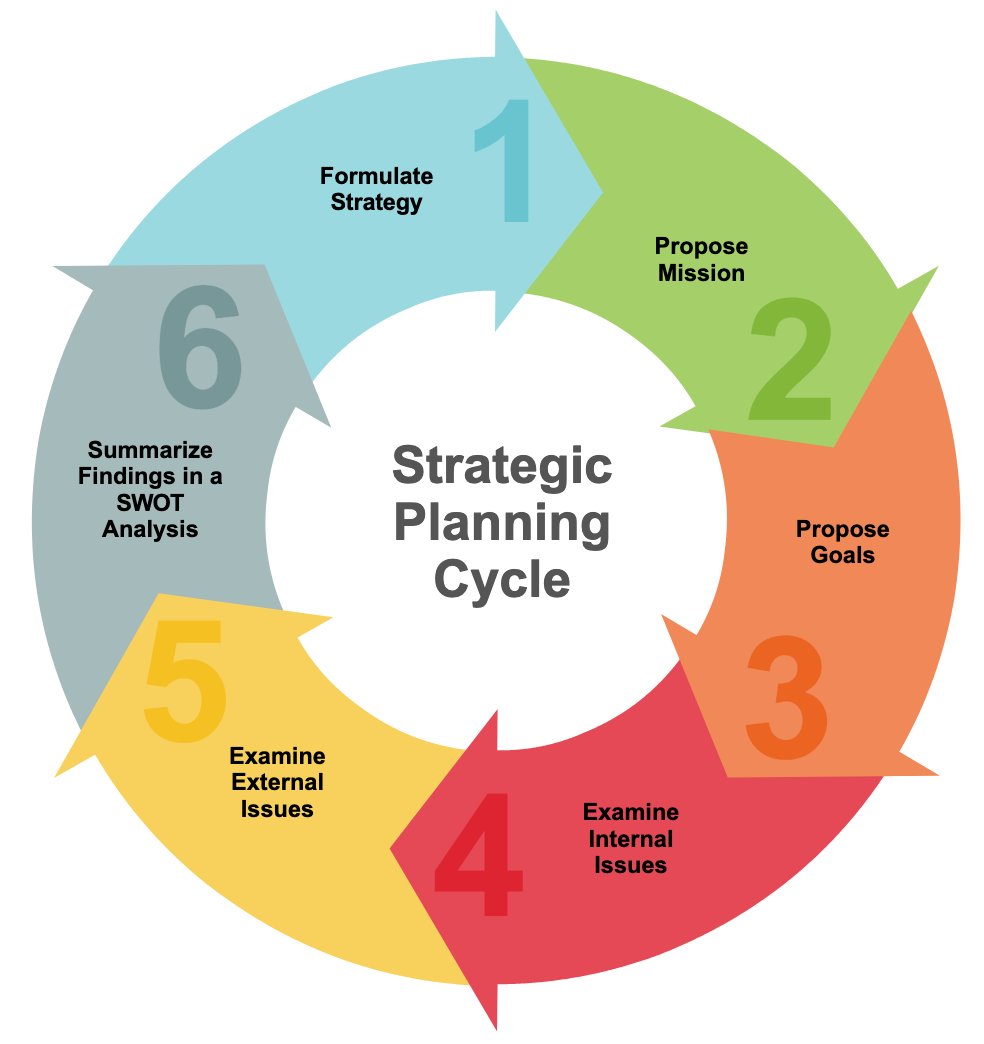

A common framework for this process involves a distinct cycle:

- Propose a Mission: Clarifies the organization's fundamental purpose.

- Examination of External Issues: Includes market dynamics, competitive landscape, and technological shifts.

- Examination of Internal Issues: Includes resources, capabilities, and operational efficiencies.

- SWOT Analysis: Consolidates insights from the internal and external examinations.

- Propose Goals: Sets specific, measurable objectives.

- Formulation of Strategy: The overarching plan to achieve goals.

- Summarization of Findings: Ensures clarity and alignment.

This cyclical nature underscores that strategic planning is an ongoing endeavor, allowing organizations to adapt and learn.

Benefits ✅:

- Focuses attention on major questions and priorities early.

- Increases the likelihood of meeting clearly defined objectives.

- A participative approach provides a strong foundation for implementation.

- Serves as a solid communication channel for project teams.

Hurdles 🚧:

- A primary challenge is resistance to change.

- The pressure to "get the show on the road" can lead to strategic thinking being pushed aside.

1.2 SWOT Analysis: Framework and Application 📊

A SWOT analysis is a widely utilized framework designed to evaluate a company's competitive position by assessing its internal Strengths (S) and Weaknesses (W), alongside external Opportunities (O) and Threats (T). This tool facilitates a realistic, fact-based, and data-driven examination of an organization's current state and future potential.

Conducting a SWOT analysis typically involves several steps:

- Determine the Objective: Focus on a specific objective, like evaluating a new product rollout.

- Gather Resources: Collect relevant internal data and external information. Involving a diverse group can provide richer insights.

- Compile Ideas: Brainstorm factors for each of the four quadrants.

- Refine Findings: Review, consolidate, and prioritize the most significant factors.

- Develop Strategy: Use the analysis to inform strategic decision-making.

The TOWS Matrix: From Analysis to Action 🚀

The TOWS Matrix is a valuable extension that transforms SWOT's diagnostic findings into actionable strategies.

- SO (Strengths-Opportunities) Strategies: Using internal strengths to maximize external opportunities. For example, leveraging a "Good distribution network" (Strength) to "Increase market share" (Opportunity).

- ST (Strengths-Threats) Strategies: Employing strengths to minimize or avoid external threats.

- WO (Weaknesses-Opportunities) Strategies: Addressing internal weaknesses by taking advantage of external opportunities.

- WT (Weaknesses-Threats) Strategies: Minimizing weaknesses and avoiding threats simultaneously.

1.3 PESTLE Analysis: Understanding the Macro-Environment 🌍

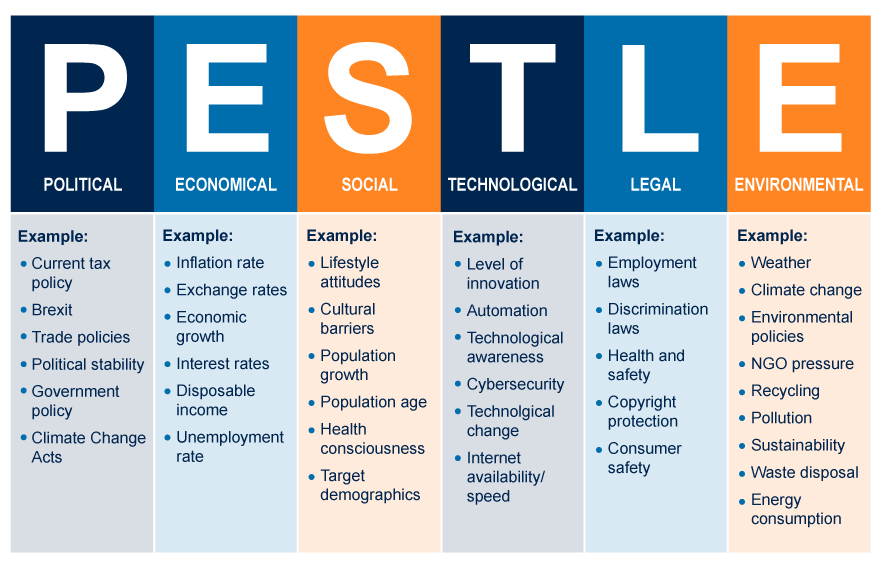

A PESTLE analysis is a strategic framework used to examine the broad macro-environmental factors that can influence an organization. The acronym stands for Political, Economic, Social, Technological, Legal, and Environmental factors. This analysis is instrumental in defining risks and adjusting project plans.

Components of a PESTLE analysis include:

- Political 🏛️: Government policies, political stability, tax policies.

- Economic 💹: Economic growth, inflation rates, labor costs.

- Social 👨👩👧👦: Societal trends, demographic shifts, consumer tastes.

- Technological 💻: Automation, innovation, disruptive technologies.

- Legal ⚖️: Changes in legislation, data protection laws, employment law.

- Environmental 🌱: Environmental restrictions, climate change impacts, CSR.

The value of PESTLE analysis is realized when it functions as a dynamic sensor for emerging risks and opportunities through continuous monitoring.

1.4 Developing & Transforming Business Models 🏗️

A Business Model describes how an organization creates, delivers, and captures value. Experimentation is a key factor in developing new business models.

Core components include:

- Value Proposition: Addresses "Who are the clients?" and "What products/services are offered at what price?".

- Value Architecture: Describes "How does the business operate?".

- Profit Equation / Revenue Model: Answers "How much revenue is generated?".

The Business Model Canvas 🖼️

Developed by Alexander Osterwalder, this canvas is a widely adopted visual template for developing or documenting business models. It consists of nine interconnected building blocks:

- Customer Segments

- Value Propositions

- Channels

- Customer Relationships

- Revenue Streams

- Key Resources

- Key Activities

- Key Partnerships

- Cost Structure

Understanding a customer's "Job to be Done" (JTBD) is a powerful catalyst for crafting a compelling Value Proposition.

1.5 Types of Business Models 💡

Modern businesses often integrate elements from multiple model types.

- Multisided Platforms: Facilitate interactions between two or more interdependent groups (e.g., sellers and buyers). An example is Airbnb. They rely on network effects and community building.

- Usage-Based Models: Revenue is generated based on the extent a customer uses a product or service. An example is DriveNow car-sharing.

- Data-Based Models: Leverage data as a core asset to create value. Examples include Netflix using viewing data for content production and Alibaba Credit using purchase data to offer financial products.

1.6 Corporate Strategy vs. Business Strategy 🏢

- Corporate Strategy: The highest-level plan defining the overall direction for the entire organization (3-5 years). It answers, "In which industries should the company compete?".

- Business Strategy: Operates at the business unit level, outlining how that unit will compete in its market (e.g., annual plan). It answers, "How will we achieve a competitive advantage?".

These two levels are deeply interdependent and require robust alignment.

1.7 Market Leadership Strategies (Treacy & Wiersema) 🏆

Successful companies typically excel by mastering one of three "value disciplines" while maintaining competence in the other two:

- Customer Intimacy: Building deep, lasting relationships with customers by providing tailored solutions.

- Product Leadership: Producing a continuous stream of innovative, cutting-edge products.

- Operational Excellence (Cost Leadership): Providing reliable products at competitive prices with minimal inconvenience.

1.8 Identifying and Leveraging Core Competencies (Prahalad & Hamel) ⭐

Core competencies are the collective learning and unique strengths of an organization that provide distinctive value to customers. A capability must meet three criteria to be a core competency:

- Relevance/Customer Value: Makes a significant contribution to customer benefits.

- Difficulty of Imitation: Difficult for competitors to replicate.

- Breadth of Application: Leverageable across different markets and product lines.

1.9 Innovation Frameworks 🚀

- Frugal Innovation: Reducing the complexity and cost of a good, often by removing nonessential features.

- Incremental Innovation: Making small, gradual, and continuous improvements to existing products or processes.

- Disruptive Innovation: Creates a new market and value network, eventually displacing established firms (e.g., Netflix streaming). It requires an enabling technology, an innovative business model, and a coherent value network.

Organizations that can manage both incremental (exploitation) and disruptive (exploration) innovation are termed "ambidextrous".

1.10 Essentials of Competition Law ⚖️

Competition law governs how businesses compete to promote fairness and prevent consumer harm. It regulates three main areas:

- Anti-competitive Agreements and Practices:

- Horizontal Agreements (between competitors): Price fixing, market sharing, bid rigging.

- Vertical Agreements (between different supply chain levels): Resale Price Maintenance (RPM), exclusivity arrangements.

- Abuse of a Dominant Position: Companies with significant market power cannot impose unfair prices or trading conditions.

- Mergers and Acquisitions (M&A): Reviewed to ensure they don’t substantially lessen competition.